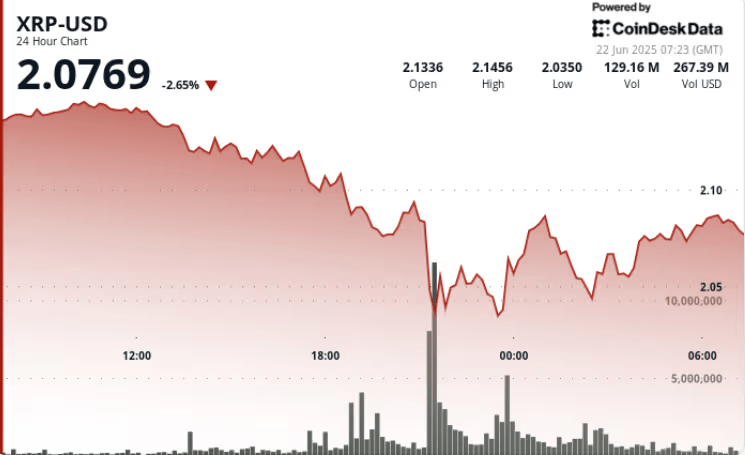

Price action in Ripple’s XRP has shifted following renewed weakness across major crypto markets, and the latest XRP Ripple nieuws reflects this bearish turn. Traders monitoring key technical levels have seen selling intensify, pushing the token below recent support thresholds. This shift underscores how interconnected XRP remains with broader risk sentiment, rather than idiosyncratic catalysts.

In the wake of this movement, market participants are now evaluating whether current levels can hold or if deeper retracement is imminent. Understanding the forces at play and the technical structure beneath the current price zone is essential for anticipating the next directional leg.

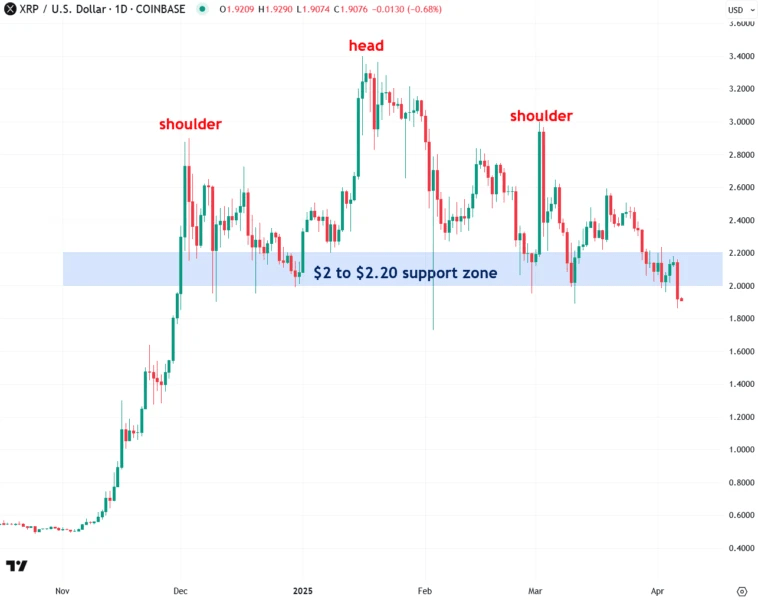

Breakdown Below Key Support Marks a Bearish Shift

XRP’s decline was not triggered by token-specific fundamentals, but rather broader market risk-off sentiment that spilled over into high-beta assets.

Weakness in Broader Crypto Sentiment

As bitcoin and other leading cryptocurrencies retraced, selling pressure rippled through altcoins. XRP’s correlation with larger market trends meant that it could not hold above critical support zones.

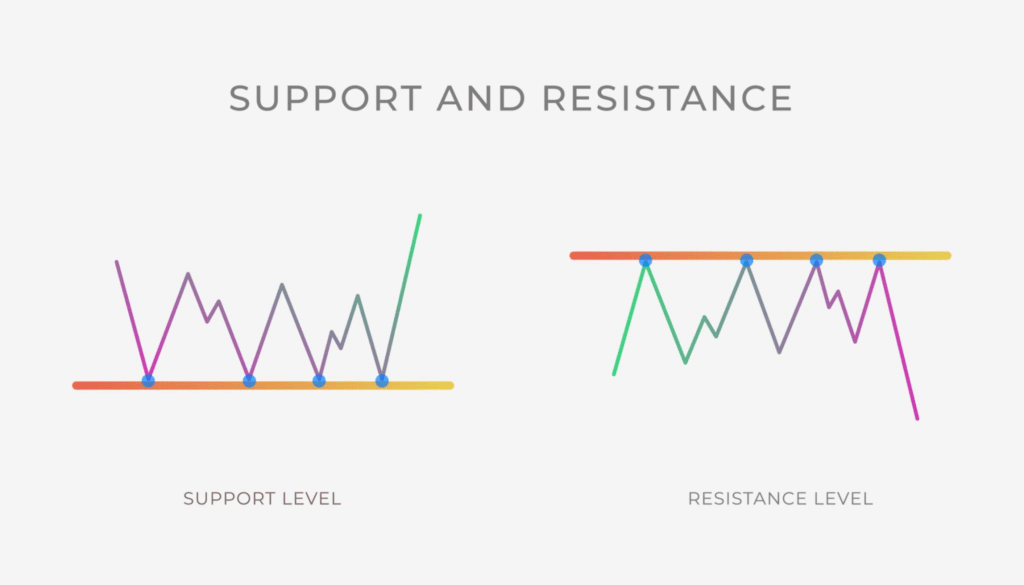

Failure of $1.87 Support Level

A decisive break below the $1.87 support zone accelerated selling. Volume spiked as sellers gained control, and this technical breach erased recent gains.

Short-Term Structure Turns Bearish

Following the breakdown, the short-term trend shifted. Price action now favors downside momentum until new demand is found.

Market Participants Assess Immediate Price Zones

The current price around $1.80–$1.78 is proving pivotal for XRP’s near-term direction.

Buyers Defend Lower Range

At the end of the latest trading session, buyers stepped in near $1.78, slowing the descent and creating a zone of interest.

Resistance Becomes Support Turned Resistance

The former support at $1.87 now acts as a resistance threshold. A return above this level is needed to question the bearish outlook.

Implications for Next Price Moves

Traders are watching immediate levels closely. A sustained hold above $1.80 could signal stabilization, while a failure may accelerate the slide.

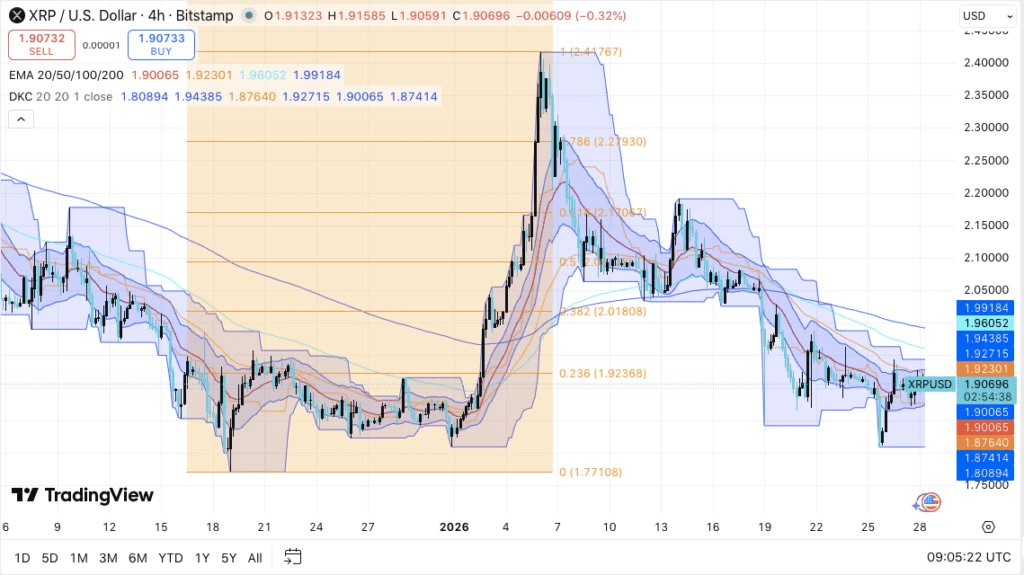

Technical Levels Define Near-Term Bias

Technical analysis remains a critical tool for interpreting XRP Ripple nieuws, especially when broader market sentiment lacks clear directional drivers.

Immediate Support and Resistance

- $1.80 Zone: Key defense area for bulls

- $1.87–$1.90: Resistance cluster that needs reclaiming

- $1.73: Secondary support target if breakdown continues

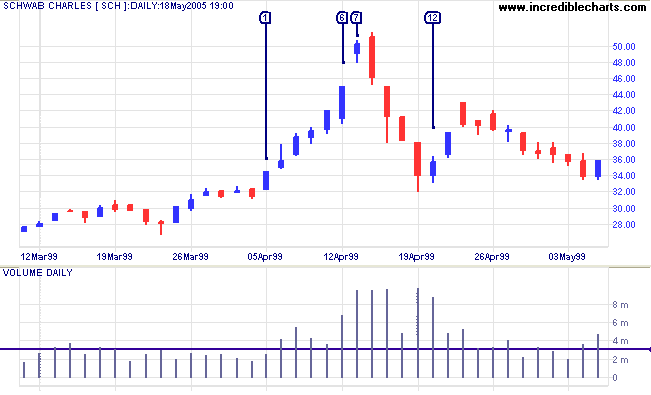

Trading Volume Confirms Downside Commitment

Increased volume during the decline suggests that selling pressure was not shallow or isolated. Volume confirmation adds weight to the bearish structure.

Momentum Indicators Still Bearish

Short-term oscillators indicate downward pressure, with limited bullish divergence to suggest an imminent reversal.

Scenarios Ahead: Stabilization vs Continuation Lower

Two primary scenarios emerge from the current XRP market structure based on XRP Ripple nieuws and technical sentiment.

Scenario 1: Stabilization Above $1.80

If buyers defend the $1.80 zone, price may consolidate sideways. This setup could create a base for a corrective bounce, but only a break above ~$1.87 would shift short-term sentiment neutral to slightly bullish.

Scenario 2: Breakdown and Move Toward $1.70

Should $1.80 fail decisively, selling pressure may drive XRP toward the $1.70 zone. This move would align with increasing downside momentum and a broader risk-off environment in crypto markets.

Volume and Order Flow Define Strength of Moves

Understanding where market participation is concentrated can shed light on the durability of either scenario.

High Volume Selling Signals Commitment

The uptick in sell-side volume during the drop indicates that many participants were eager to exit positions once support levels broke.

Absence of Strong Buy Volume

Despite defenses around $1.78–$1.80, buy-side volume has not demonstrated sustainable strength, which keeps the risk tilted toward continued downside.

Order Book Dynamics

Thin order book layers near current trading zones can exacerbate moves, leading to swift price changes once critical levels are breached.

Broader Crypto Market Influence on XRP Direction

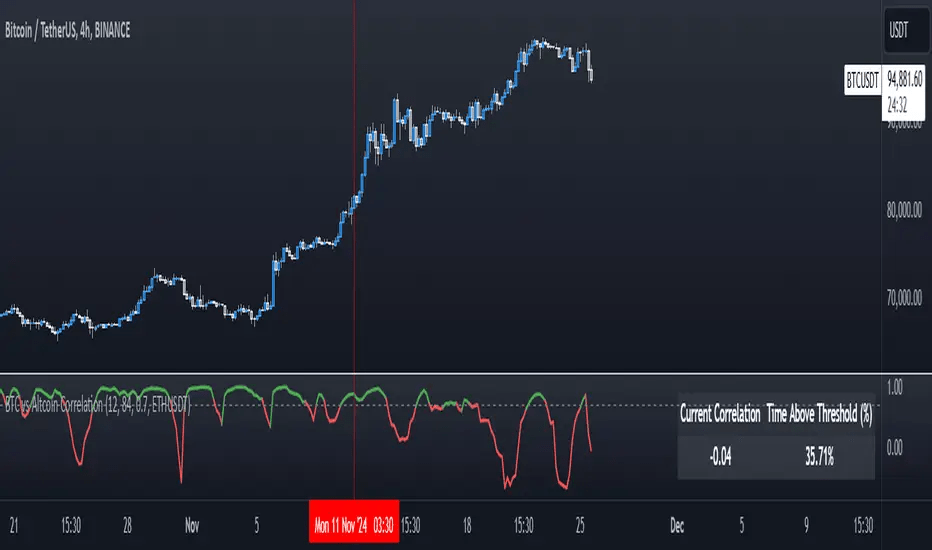

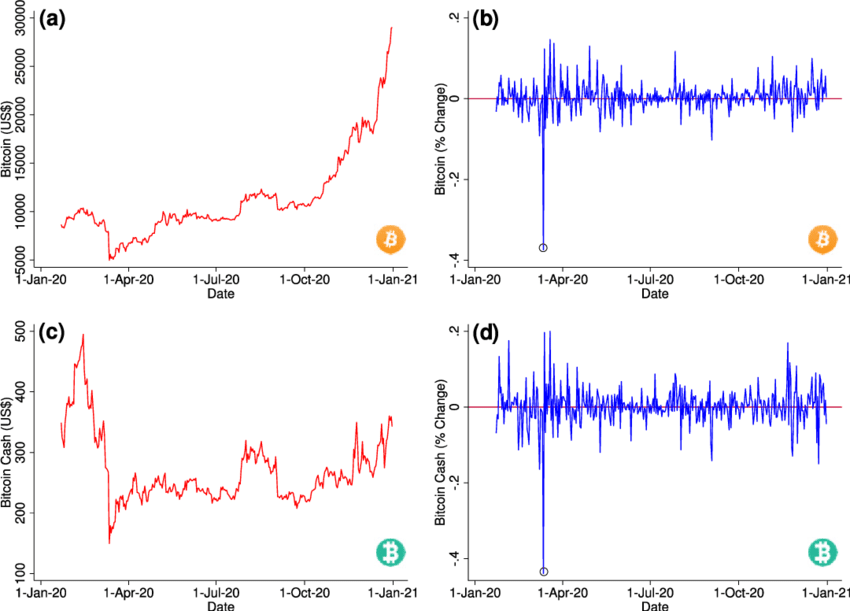

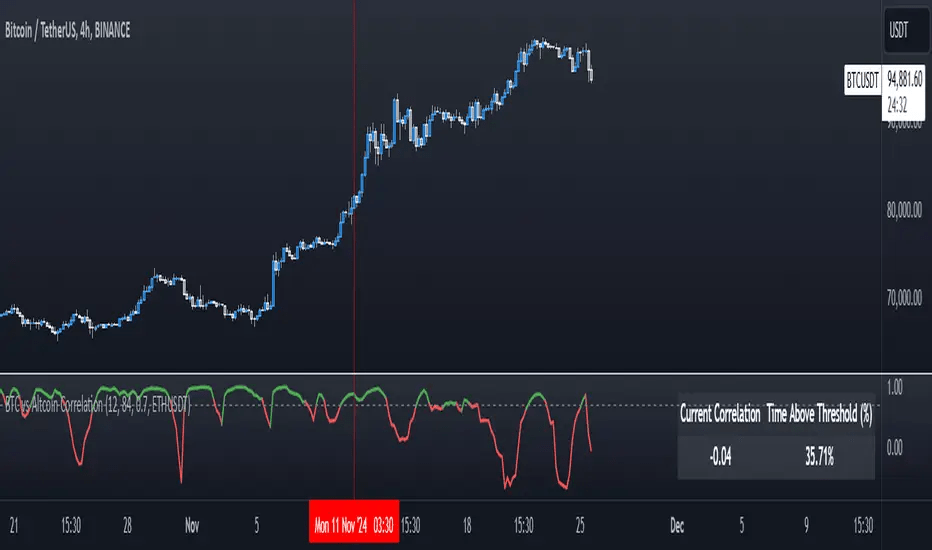

XRP trading behavior remains correlated with movements in larger crypto assets, especially bitcoin.

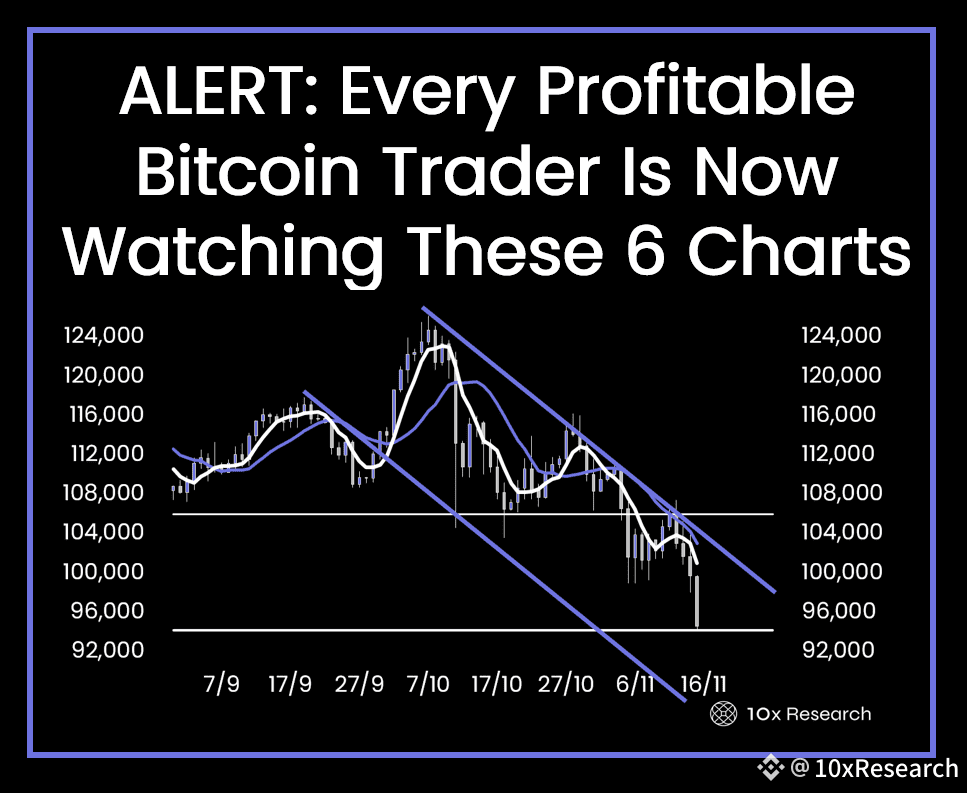

Bitcoin’s Influence on Risk Appetite

As bitcoin retreated, risk-on assets like XRP felt pressure. The broader market’s risk-off positioning forced traders to reduce exposure to leveraged or high-beta tokens.

Correlation Patterns Remain Evident

Patterns of correlation between XRP and bitcoin persist, showing that macrocrypto swings influence XRP’s structure more than isolated token events.

Sentiment Feedback Loop

Market sentiment feeds into volume and momentum; bearish sentiment can intensify selling as positions are unwound.

How Traders Are Positioning Based on XRP Ripple Nieuws

Active traders are adjusting their strategies based on the technical framework and emerging price behavior.

Short-Term Traders Seek Lower Targets

With bearish structure dominating, short-term traders may probe lower support levels for tactical entries or profit-taking exits.

Range Traders Watch Support Bands

Those trading ranges are monitoring the $1.78–$1.80 zone for potential sideways trading opportunities.

Breakout Players Need Confirmation

Players anticipating directional breakouts need confirmation of either a reclaim above resistance or a breakdown below key supports.

Key Levels to Watch in the Coming Sessions

A focused set of levels will likely guide short-term decision-making for XRP participants.

- $1.87: Resistance zone for trend validation

- $1.80: Critical pivot between stabilization and further declines

- $1.73: Downside target if selling accelerates

- Volume Profile Points: Areas where trade volume clusters can act as magnets or barriers

What This Means for Broader Market Interpretation

XRP’s move serves as a barometer for how correlated risk assets might behave during broader selloffs.

Holders and traders pay close attention to XRP Ripple nieuws not just for token-specific updates, but also as a reflection of sentiment across risk-oriented crypto assets.

The price action suggests:

- Market participants are reactive to technical signals

- Broader market influences outweigh token-specific catalysts

- Key support levels define sentiment thresholds

Given the interconnectedness of crypto risk assets, shifts in XRP behavior often foreshadow or reflect larger market patterns.

Strategic Takeaways for Participants

Understanding the implications of recent price behavior can inform risk management and positioning.

- Define clear risk thresholds around key technical levels

- Monitor volume for confirmation of moves

- Align expectations with broader market sentiment

The persistence of downside pressure keeps the spotlight on support and resistance structures that define the next significant moves.

Summary of Recent XRP Price Action

A 5% intraday drop has pushed XRP into a sensitive technical zone, altering the near-term bias.

| Key Metrics | Value |

| Peak Before Drop | $1.91 |

| Support Breach Level | $1.87 |

| Intraday Low | $1.78 |

| Recovery Attempt Zone | $1.80 |

| Immediate Resistance | $1.87–$1.90 |

| Downside Risk Target | $1.73 |

This technical behavior highlights how critical momentum shifts can occur in thin liquidity environments. As XRP Ripple nieuws continues to focus on real-time support/resistance pivots, traders remain laser-focused on these bands.

How the Broader Market May Influence the Path Forward

The lack of XRP-specific catalysts suggests that the next directional move will be defined externally—especially by bitcoin’s next leg.

Bitcoin’s Trend Determines Altcoin Conditions

Should BTC continue to stabilize, XRP may benefit from oversold conditions and attempt a rebound. But if BTC loses key levels, pressure will return immediately.

Cross-Market Liquidity Still Fragile

Crypto liquidity remains fragmented. Any coordinated downside in majors tends to amplify effects in assets like XRP, especially during U.S. and Asia trading overlaps.

ETF News and Regulatory Headlines

Any sudden news regarding Ripple’s ongoing regulatory positioning or broader ETF flows could introduce volatility. Until then, technicals and correlation dominate.

Risk Map for XRP Traders and Analysts

For active market participants using XRP Ripple nieuws to guide decisions, a well-defined tactical roadmap helps in managing positions effectively.

- Above $1.87: Structure improves and may target $1.94–$2.00

- Between $1.80–$1.87: Consolidation zone; low conviction moves

- Below $1.80: Downside opens toward $1.73, with risk of momentum spike

Keeping position sizing dynamic and reactive to key level behavior will be critical in this phase. The convergence of technical breakdown, macro correlation, and risk-off behavior suggests the market will reward patience and discipline rather than speculation.