Cryptocurrencies fell sharply as weekend trading conditions amplified selling pressure and triggered cascading liquidations. The crypto crash today was marked by outsized moves in Ethereum and XRP while Bitcoin showed relative stability. Sudden drawdowns like this expose weaknesses in market structure, especially when active liquidity is low and automated systems dominate price discovery.

Weekend volatility often feels unjust to participants because it hits hardest when traders are offline and depth is shallow. The pattern we saw has both technical and behavioral components, shaping near‑term price dynamics and trader risk responses.

Market Dynamics Behind the Weekend Slide

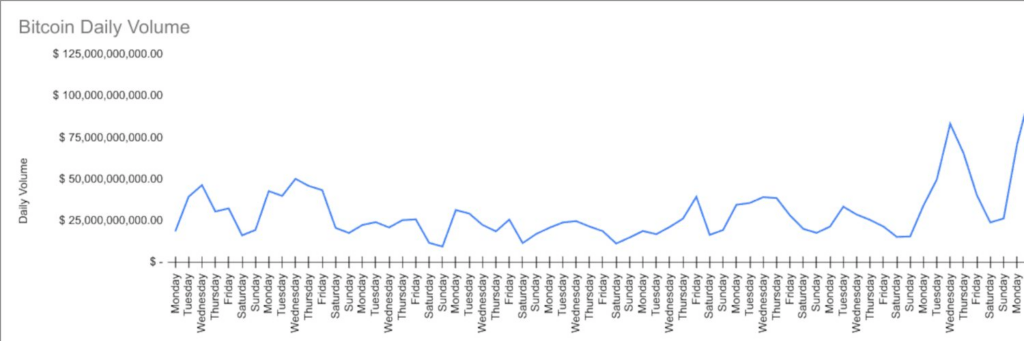

The timing of the crypto crash today matters because weekend markets have distinct characteristics that can exaggerate price swings.

Weekend Liquidity Conditions

Fewer active traders mean thinner order books. When major assets move sharply, there are fewer natural buyers and sellers to absorb those flows.

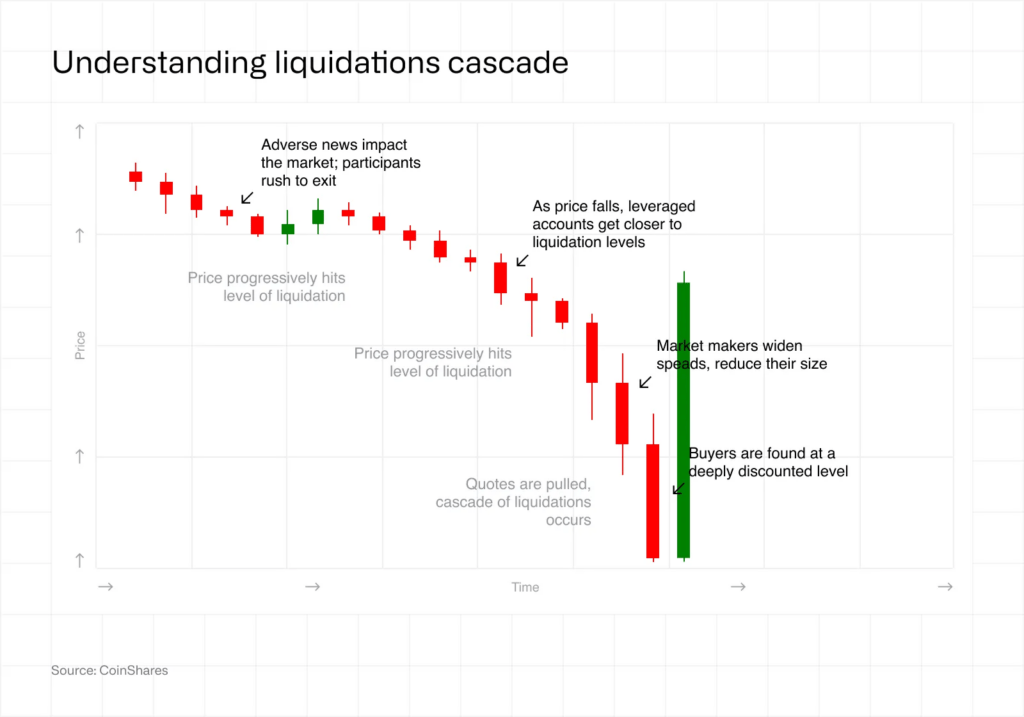

Automated Liquidations Trigger Triggers

When price breaks key levels, stop orders and algorithmic liquidations execute without human intervention. This can create sudden gaps.

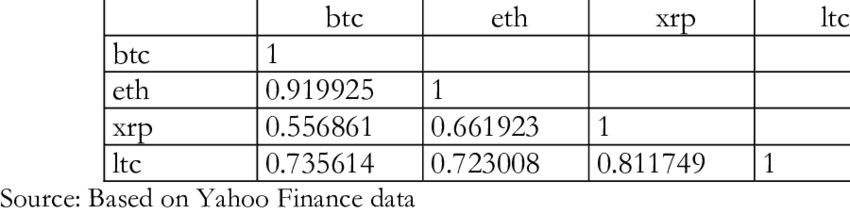

Correlation Across Assets

In this latest drop, both Ethereum and XRP experienced far larger percentage declines than Bitcoin, demonstrating how correlated altcoins can amplify downside risk.

How ETH and XRP Led the Decline

During a concentrated period of selling pressure over the weekend, Ethereum and XRP were among the hardest hit on a relative basis.

Ethereum’s Volatility Spike

ETH dropped significantly beyond typical trading ranges, reflecting both speculative positioning and technical selling cascades.

XRP’s Deeper Pullback

XRP’s slide was even steeper, indicating higher sensitivity to beta risk and reduced liquidity deeper into the altcoin spectrum.

Bitcoin’s Relative Stability

Bitcoin, despite slipping below major integer levels, did not fall as sharply. This suggests larger cap assets with stronger base demand can resist amplified moves somewhat better.

Mechanics of the Recent Selloff

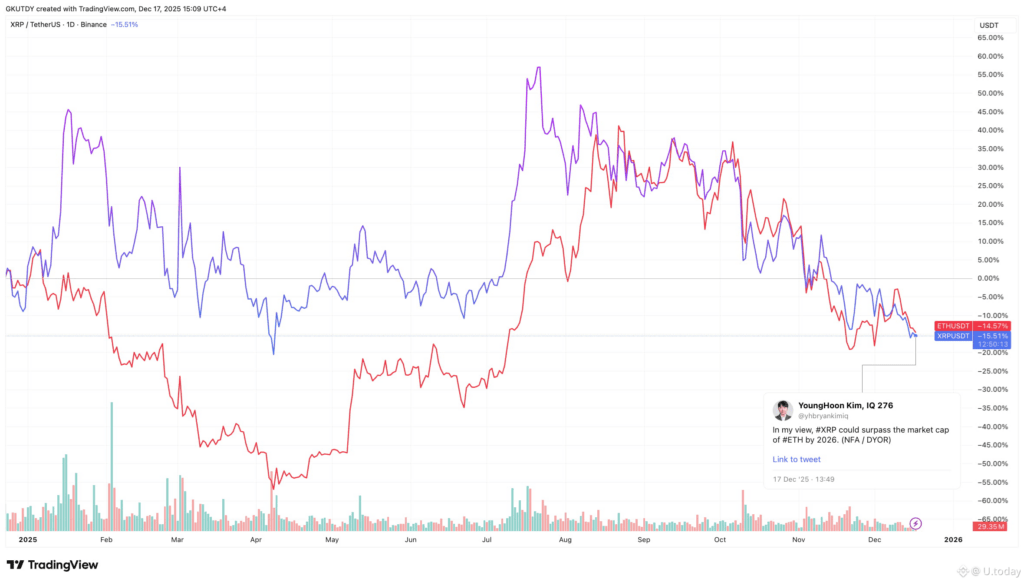

The crypto crash today can be understood in part by examining leverage and price structure.

- Liquidations increase selling pressure when leveraged long positions are forcibly closed

- Thin liquidity means each executed order moves prices more than during high‑volume periods

- Automated systems do not discriminate noise from structural breakdown

These forces together create a feedback loop: break one floor, and deeper floors get tested rapidly without firm bids to slow the descent.

Price Action and Market Cap Impact

The selloff shaved significant value from the total ecosystem.

| Metric | Value at Peak Drop |

| Bitcoin Low | Approx $75,600 |

| Ethereum Drop Range | Up to about 18% down |

| XRP Price Low | Around $1.58 |

| Total Market Cap Decline | Over $200 billion |

| 24‑Hour Liquidations | Just below $2.5 billion |

This table reflects how the crypto crash today was not a minor blip but a sudden re‑pricing event that shocked multiple asset classes.

Behavioral Triggers and Crowd Psychology

Trader psychology plays a central role in how these collapses unfold.

Panic and Reflex Selling

When key support levels break, many participants exit positions reflexively rather than strategically.

Fear Amplifies Moves

Social media and market chatter can intensify sentiment shifts, driving additional selling and reinforcing bearish momentum.

Weekend Timing Increases Surprise

Fewer active traders mean that surprise events can trigger outsized reactions, simply because bid depth is weaker and participants cannot respond in real time.

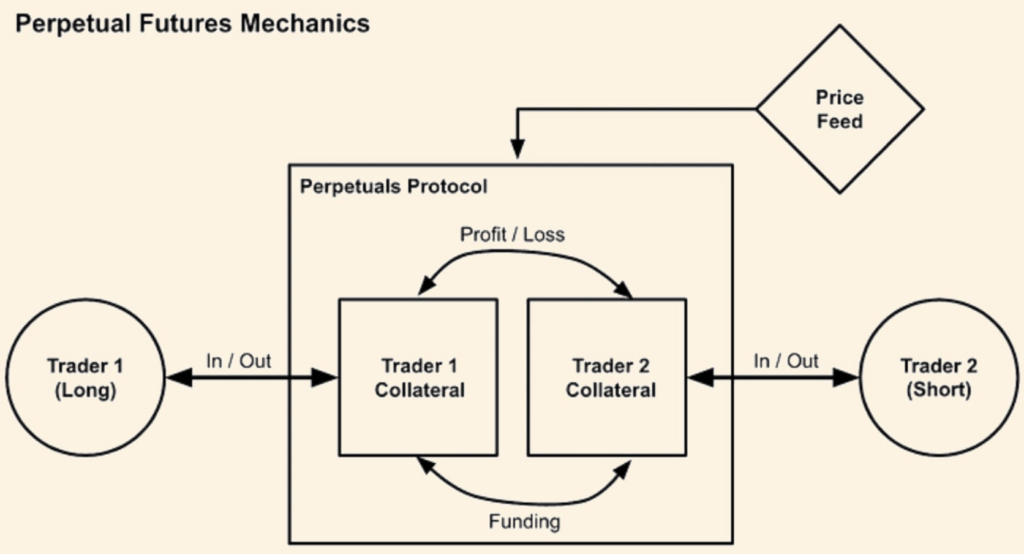

Market Structure: Why Saturday Sessions Hurt More

The mechanics of weekend markets differ from weekday sessions.

Reduced Maker‑Taker Activity

Market makers may withdraw to avoid unattractive spreads during low activity, reducing liquidity further.

Increased Reliance on Algo Flows

Automated strategies take precedence over human decision‑making during these periods, causing sharper execution and deeper price moves.

Absence of Institutional Flows

Institutional participants typically operate in primary business hours, leaving weekends dominated by retail and automated flows.

Macroeconomic Noise as a Catalyst

While structural issues in crypto markets set the stage, macro events can still act as catalysts.

Geopolitical Headlines

Significant global events can spook risk sentiment and lead traders to re‑assess positions outside normal market hours.

Cross‑Asset Correlation

When traditional assets move due to macro drivers, crypto traders often adjust exposure swiftly, adding to volatility.

Dollar Strength and Safe‑Haven Rotation

Flows into perceived safe‑haven instruments or currencies can induce selling in risk assets, including crypto.

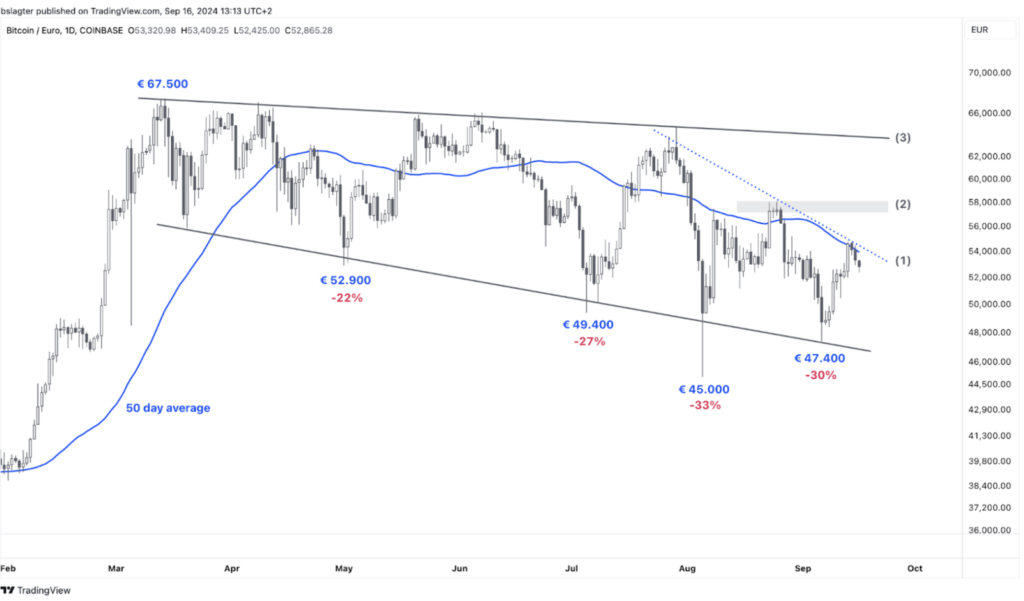

Immediate Technical Levels to Watch

Following the crypto crash today, technical analysts are tracking key pivot points that may define the next moves.

Support Zones

Several price bands now act as potential support for major assets after sharp moves.

Resistance Thresholds

Levels that previously held as interim tops may now function as resistance, slowing any retracement.

Momentum Signal Crossovers

Oscillators and volume indicators point toward continued short‑term pressure until meaningful demand returns.

Which Assets Are Most Vulnerable

During broad selloffs like this, certain segments experience disproportionate pressure.

- Smaller cap and illiquid tokens

- Assets with high leverage usage

- Pairs denominated in derivatives rather than cash markets

These categories typically show deeper drawdowns and slower recoveries in disruptive environments.

What Traders Are Saying About the Crash

Market participants have various interpretations of the crypto crash today.

Some See Buying Opportunities

A view among certain traders is that sharp moves create tactical entry points for high‑conviction assets.

Others Warn of Deeper Weakness

Contrarian voices argue that structural risk and poor liquidity profiles may prolong or deepen drawdowns.

Short‑Term vs Long‑Term Perspectives

Short‑term traders focus on price action and technicals, while long‑term holders emphasize fundamental narratives and adoption trends.

Risk Management Lessons From the Selloff

The newest downturn underscores the importance of risk protocols.

- Avoid heavy leverage during volatile regimes

- Define clear stop levels tied to technical behavior

- Maintain liquidity buffers to weather sharp moves

Being proactive with risk controls often determines whether a trader survives extreme drawdowns.

The first half of the article is complete, ready to continue.

continue

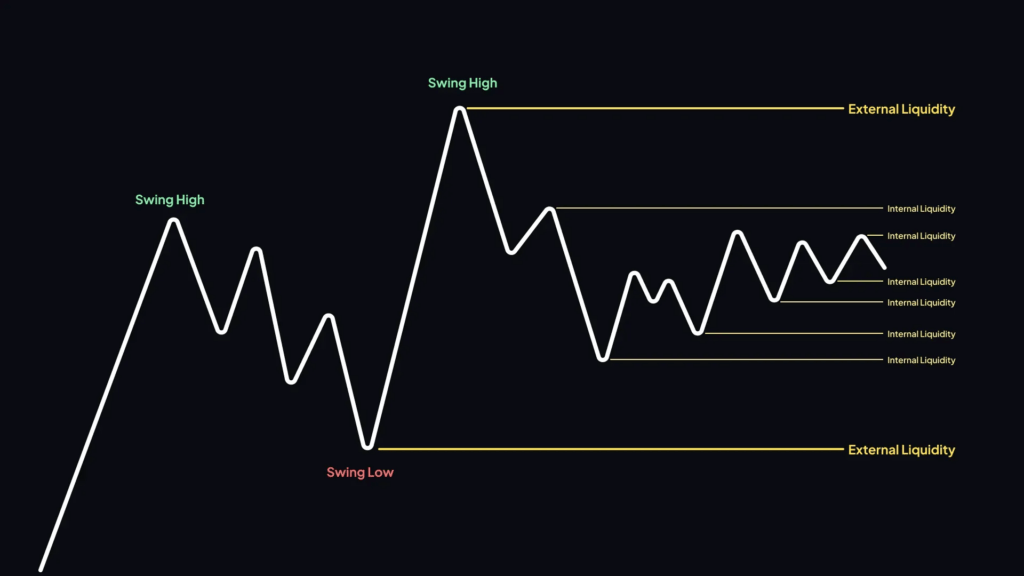

How Liquidity Gaps Turn Pullbacks Into Crashes

What separates a routine dip from a full‑scale breakdown is liquidity. The crypto crash today demonstrated how quickly markets can unravel once depth disappears.

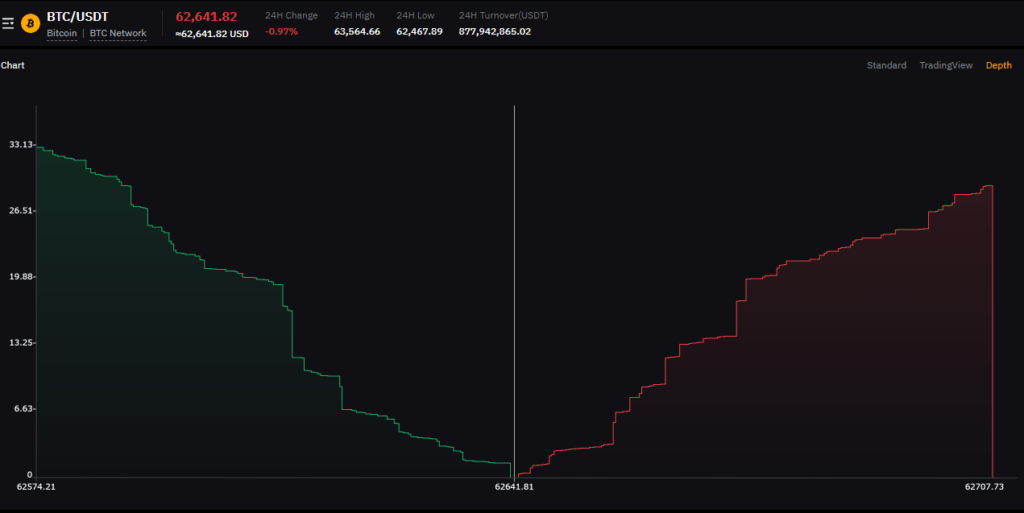

Order Book Fragility

During off‑hours, visible bids thin out. When sell orders hit, there is little resistance, allowing price to slide rapidly through multiple levels.

Slippage and Forced Execution

Large orders execute across several price bands, creating slippage that accelerates declines and triggers secondary liquidations.

Feedback Loops in Thin Markets

Each liquidation worsens liquidity, making the next liquidation even more damaging. This loop is especially potent on weekends.

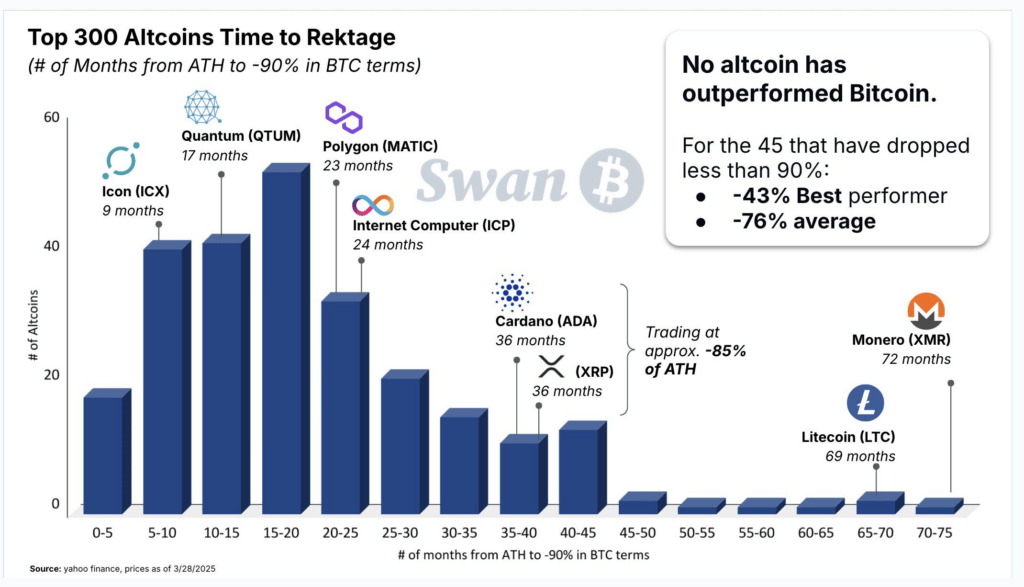

Why Altcoins Suffer More Than Bitcoin

The question many are asking is why is crypto crashing unevenly across assets. The answer lies in risk hierarchy.

Risk Curve Positioning

Bitcoin sits at the top of the crypto risk curve. Ethereum follows. XRP and other altcoins sit lower, where liquidity and conviction weaken faster.

Crowded Positioning

Altcoins often attract speculative leverage. When sentiment flips, these positions unwind first and fastest.

Memory of Prior Liquidations

Assets that recently experienced cascades tend to gap again more easily, as traders pre‑emptively manage them as fragile.

The Leverage Layer Beneath the Market

Leverage remains the silent multiplier behind every sharp crypto move.

Funding Rate Sensitivity

When funding flips negative, it signals stress. Traders rush to reduce exposure, reinforcing downside momentum.

Options Skew as a Warning Signal

A sharp rise in put demand indicates defensive positioning. Dealer hedging linked to this flow often adds selling pressure.

Margin Thresholds Matter

Once widely watched levels break, liquidations become mechanical rather than discretionary.

Weekend Markets vs Weekday Markets

Another core reason why is crypto crashing during weekends is the absence of stabilizing flows.

Missing Institutional Bid

Spot ETFs, funds, and corporate desks do not actively support prices outside business hours.

Retail and Algo Dominance

Retail traders and automated systems dominate, increasing sensitivity to headlines and technical triggers.

Delayed Price Discovery

Instead of gradual adjustment, price discovery happens in bursts, often overshooting fair value.

Possible Paths After the Crash

Following the crypto crash today, three realistic market paths emerge.

1. Volatile Stabilization

Liquidity returns during the week, selling pressure fades, and prices chop within a wide range as confidence rebuilds.

2. Grind Lower

If macro sentiment stays defensive, markets may drift lower as buyers wait for clearer signals.

3. Partial Decoupling

Bitcoin may stabilize while altcoins remain heavy, reflecting selective risk appetite rather than broad recovery.

Key Levels Traders Are Watching Now

Market participants are focused on clear technical markers.

- Bitcoin reaction around mid‑$70,000s

- Ethereum behavior near recent wick lows

- XRP’s ability to hold post‑liquidation bases

These zones will determine whether the selloff becomes a reset or the start of a deeper trend.

What This Crash Reveals About Crypto Markets

The latest breakdown offers several structural lessons.

- Crypto remains highly sensitive to liquidity timing

- Leverage still dominates short‑term price behavior

- Weekend sessions amplify structural weaknesses

- Correlation with macro risk has increased

These realities shape how future shocks may play out.

Practical Takeaways for Market Participants

Understanding why is crypto crashing helps frame better decisions going forward.

- Reduce exposure before illiquid periods

- Treat weekends as high‑risk windows

- Focus on liquidity, not narratives

- Size positions assuming gaps can occur

Surviving volatility often matters more than catching the perfect entry.

Bigger Picture: Fragility, Not Failure

While the crypto crash today feels severe, it reflects fragility rather than collapse. Markets built on continuous trading, leverage, and thin depth will always experience violent repricing phases.

These episodes reset expectations, flush excess risk, and redefine where real demand exists. The next phase will not be decided by headlines alone, but by whether liquidity and confidence can return together.