FIGR, the financial technology company behind Provenance Blockchain and led by SoFi founder Mike Cagney, is rewriting the rules of equity markets. Its new On-Chain Public Equity Network (OPEN) aims to dismantle the old financial infrastructure and bring equity issuance directly to the blockchain. In a world where traditional players like the DTCC dominate, Figure is offering an alternative that’s fast, transparent, and radically decentralized.

What Is OPEN and Why It Matters

OPEN is more than a product—it’s a proposition. A direct challenge to how we issue and trade stocks.

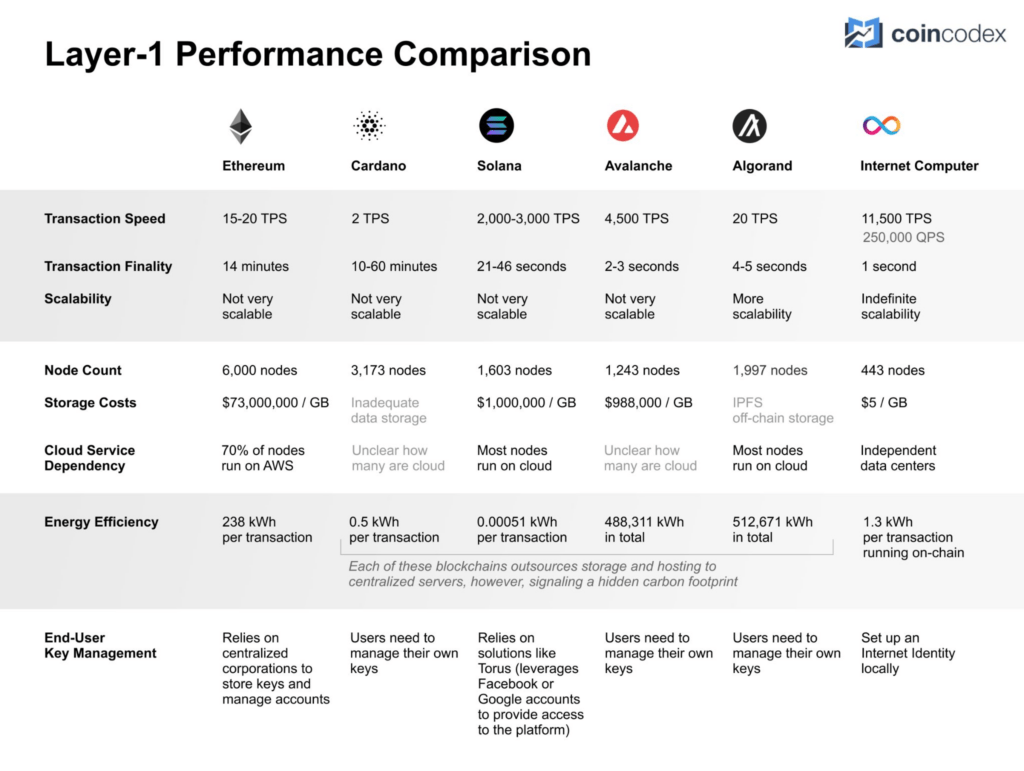

A Native Blockchain Platform

OPEN is built entirely on Provenance Blockchain, making it a first-of-its-kind in public equity infrastructure. No middlemen. No legacy systems. Just blockchain.

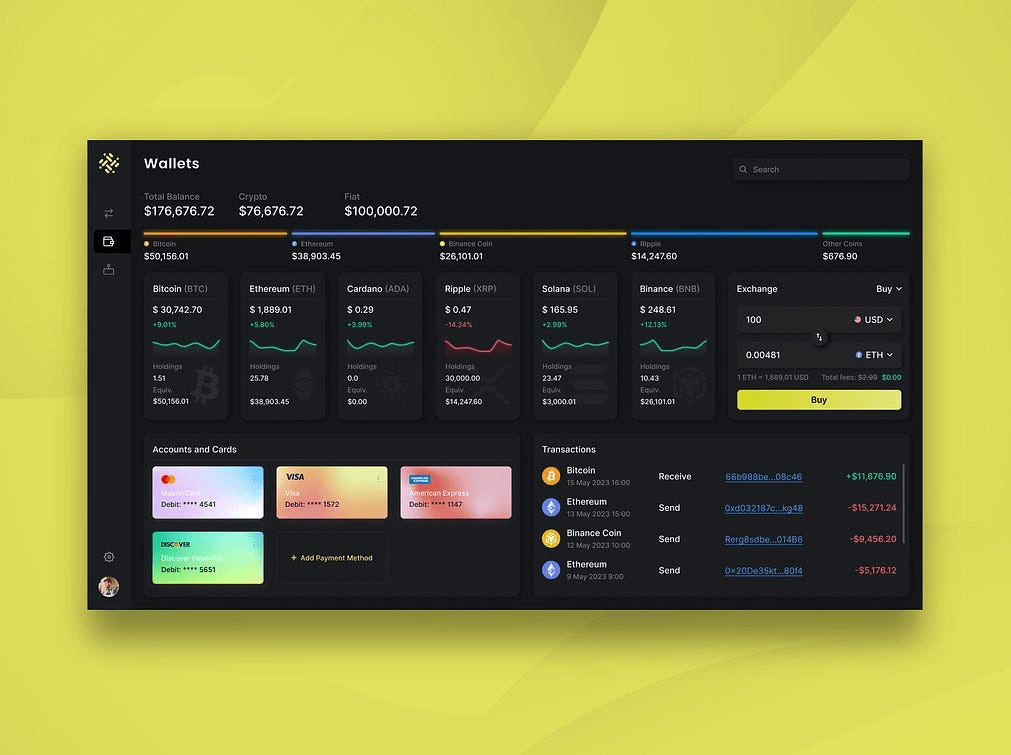

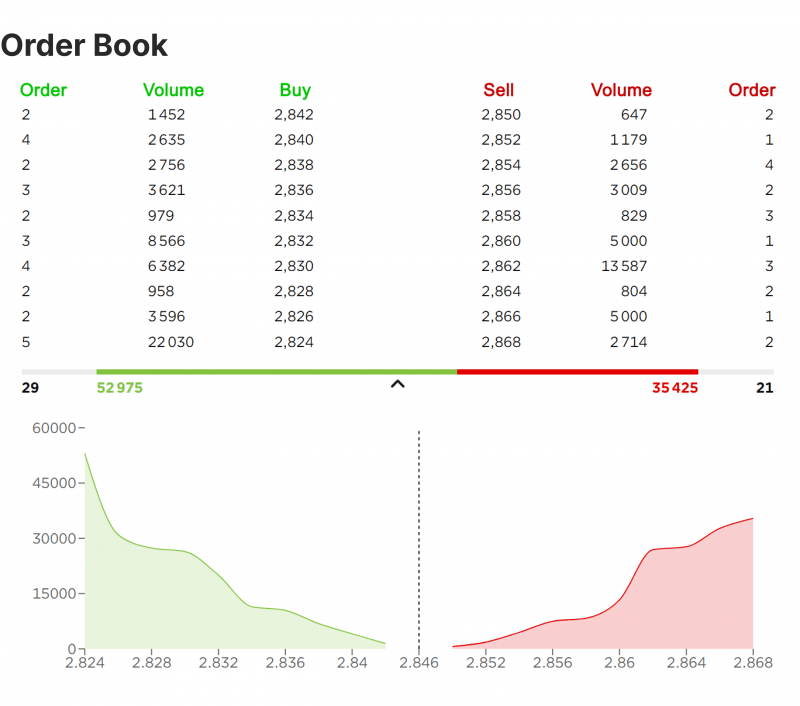

Limit Order Book via ATS

The platform integrates Figure’s Alternative Trading System (ATS), enabling real-time trading through a blockchain-based limit order book—mirroring traditional exchanges but without their inefficiencies.

Beyond Traditional Custody

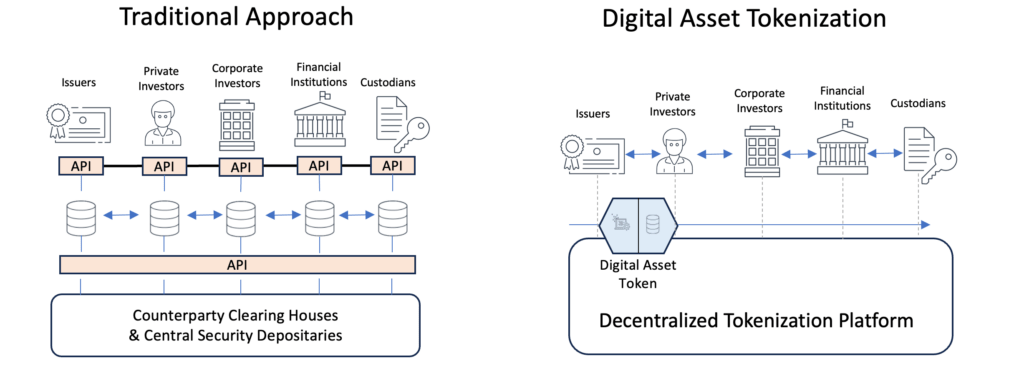

By issuing shares on-chain, OPEN eliminates the need for custodians and central clearinghouses like DTCC. This removes a critical layer of friction and cost.

FIGR Stock and the First-Mover Advantage

Figure isn’t just launching a platform. It’s also putting its own skin in the game.

Dual Listing and Secondary Offering

The company plans to dual-list its FIGR stock—currently Nasdaq-listed—and its tokenized version on OPEN. This will mark one of the first instances of a publicly traded equity going fully on-chain.

Leading by Example

By filing for a secondary share offering in November and using its own stock to debut OPEN, Figure becomes both the architect and the test case.

The Tokenization Trend in Equity Markets

Tokenization is no longer hype. It’s a market with real momentum—and real money.

Real-World Asset Tokenization

Tokenized stocks, part of the broader Real-World Asset (RWA) trend, have become a $870 million market with over $2 billion in monthly trading volume.

Wrappers vs. Native Tokens

Most tokenized equities are wrappers—blockchain representations of off-chain stocks. What OPEN offers is different: native issuance, born and traded entirely on-chain.

Advantages of Blockchain-First Equity Platforms

Why should investors or issuers care about FIGR’s tokenized model?

- Faster settlement times (minutes, not days)

- Reduced counterparty risk

- Direct access to DeFi applications

- Elimination of third-party fees

- Programmable compliance and governance

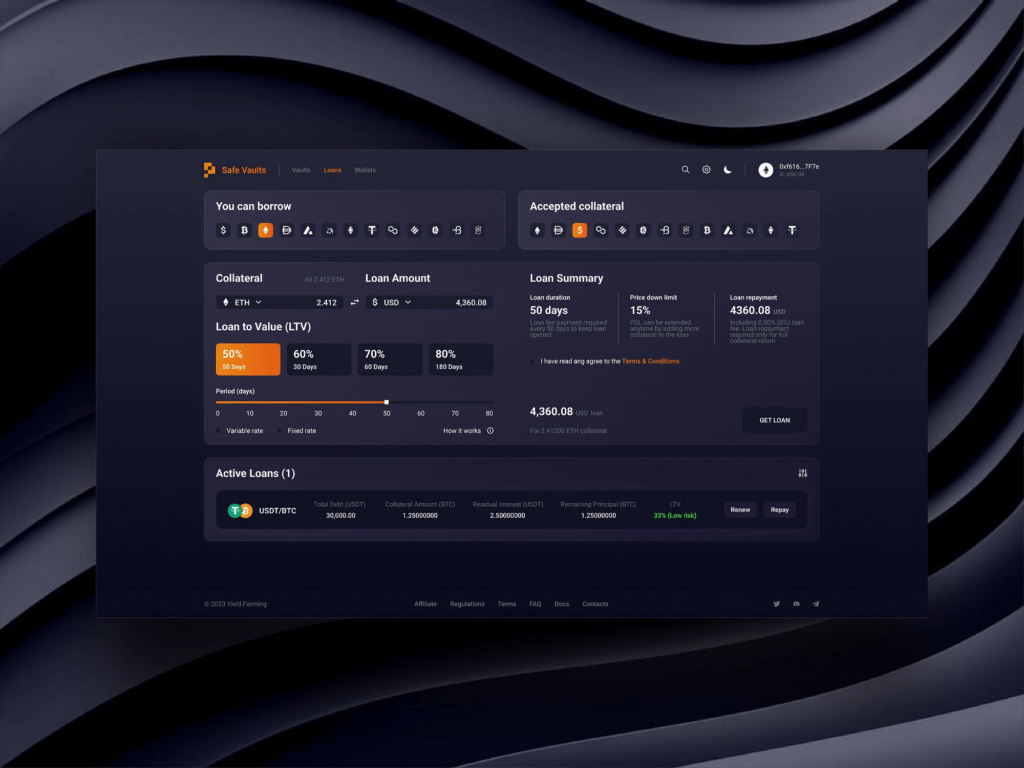

DeFi Integration and Lending Capabilities

One of OPEN’s most compelling features? On-chain composability.

Lending and Borrowing Against Holdings

Holders of tokenized equity can lend or borrow against their positions through DeFi protocols—no prime brokers required.

Liquidity Without Friction

DeFi rails provide continuous liquidity and collateralization opportunities, previously unavailable to retail investors in the traditional ecosystem.

Regulation: Threat or Catalyst?

Tokenization isn’t happening in a vacuum. Regulators are watching—and in some cases, cheering.

SEC’s Position on Tokenization

SEC Chairman Paul Atkins recently acknowledged that blockchain-based tokenization could “reshape the financial system.” That’s not pushback. That’s tailwind.

Jurisdiction and Compliance

Since OPEN is US-based and tied to Nasdaq-listed assets, it operates under clear legal frameworks, unlike many offshore DeFi projects.

Key Technical Features of the OPEN Platform

Let’s break down what powers this innovation under the hood:

| Feature | Description |

| Blockchain Infrastructure | Built on Provenance Blockchain (Layer-1) |

| Trading Engine | Integrated ATS with continuous limit order book |

| Custody | Self-custodied or wallet-based (no DTCC or custodians involved) |

| Asset Type | Natively issued tokenized equity |

| Compliance Layer | Built-in KYC/AML via smart contracts |

| DeFi Integration | Lending/borrowing via compatible DeFi protocols |

| Dual Listing Support | Traditional ticker + blockchain-native version of FIGR stock |

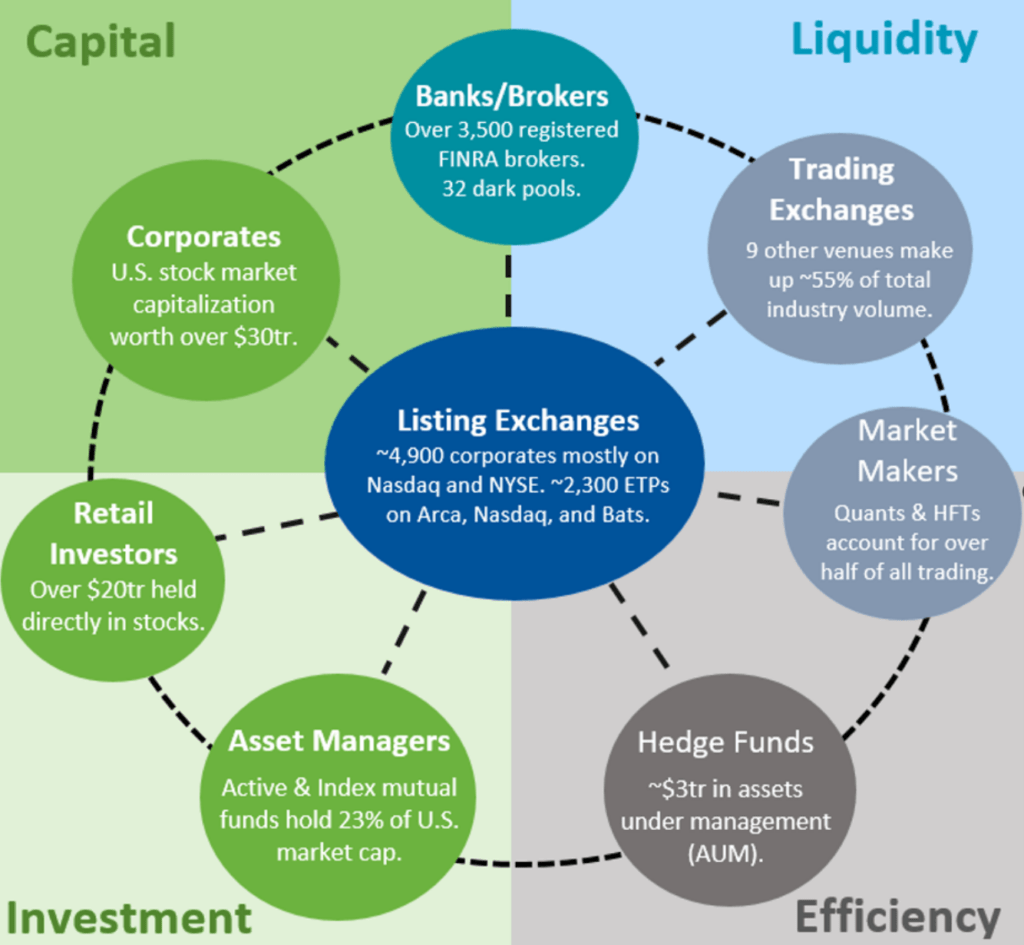

How Does OPEN Compare to Traditional Systems?

Let’s make it simple.

Traditional Public Markets:

- 2-day settlement delays (T+2)

- DTCC clearing, custodians, and fees

- Delayed access to capital for companies

- Complex, opaque recordkeeping

OPEN by FIGR:

- Real-time, on-chain settlement

- No intermediaries

- Instant issuance, fractional ownership

- Transparent, auditable ledger

Why Institutional and Retail Investors Are Watching Closely

Whether you’re managing a fund or trading independently, OPEN changes the playbook.

For Institutions

- Lower operational costs

- Direct access to equity pools

- Streamlined compliance

For Retail

- Early access to pre-IPO shares

- Transparent mechanics

- Potential for fractional participation and liquidity

A Broader Movement Toward Asset Digitization

Figure’s move is part of a macro shift: the digitization of finance. OPEN isn’t just for stocks.

- Real estate tokenization

- Credit markets on-chain

- Treasury-backed stablecoins

- Cross-border securities issuance

All signal a deeper trend—one that places programmable assets at the core of capital markets.

How OPEN Fits Into the Evolution of Capital Markets

The push to tokenize equity is not isolated—it’s part of a global move toward digitized markets. Let’s explore how OPEN fits into the broader picture of capital innovation.

From Paper Certificates to Digital Shares

Decades ago, investors held paper stock certificates. Then came digital records via clearinghouses. Now, OPEN introduces the next step: natively digital assets verifiable by blockchain consensus.

Interoperability With Other Asset Classes

By building OPEN on Provenance, Figure sets the stage for tokenized equities to interact with tokenized real estate, fixed income instruments, and stablecoins—all within one ecosystem.

Compliance and Auditing

Because every share issuance and trade is time-stamped and immutable, auditing becomes simpler and more trustworthy. OPEN’s infrastructure is designed to appeal to both auditors and regulators.

Who Stands to Lose From This Disruption?

With every innovation, there are incumbents who resist change.

- Clearinghouses (e.g., DTCC) lose their central role

- Prime brokers become less relevant

- Custodian banks see diminished margins

- Legacy trading platforms face pressure to modernize

But disruption also brings opportunity—for startups, retail investors, and forward-thinking institutions.

Is Tokenized Equity Ready for Mass Adoption?

There are still hurdles.

Technical Barriers

Wallet management, private key security, and user experience still pose challenges for mainstream users.

Liquidity Network Effects

Platforms like OPEN need critical mass—issuers, investors, and market makers—to create sustainable liquidity.

Legal Uncertainty

While the SEC has signaled openness, real regulatory harmonization will take time, especially across jurisdictions.

Early Signals: Adoption Is Accelerating

Despite the risks, market signals point toward growing adoption.

- More than 30 startups now focus on equity tokenization

- Private equity firms exploring on-chain cap tables

- Nasdaq and BlackRock researching tokenized security platforms

And with Figure making its move, others may feel compelled to act.

Why FIGR’s Timing Might Be Perfect

Sometimes success is about being early. Other times, it’s about being right on time.

- Crypto infrastructure is mature

- Institutional interest in DeFi is rising

- Regulators are no longer ignoring tokenization—they’re studying it

- The public is increasingly aware of the inefficiencies in legacy markets

All these conditions align to give OPEN a real shot at reshaping equity markets.

What to Watch in the Months Ahead

For FIGR and OPEN, a few upcoming milestones will define the road forward.

- Completion of the FIGR stock secondary offering

- Dual listing activation and first tokenized equity trades

- DeFi protocol integration for collateralized lending

- Early adoption by other issuers and investors

Should You Pay Attention to FIGR Stock Now?

If you believe in the thesis of blockchain-based finance, this isn’t just another fintech story. FIGR stock and the OPEN platform represent a practical, live implementation of what many have theorized for years.

And while the outcome is not guaranteed, the intent is bold: turn equity markets into programmable, transparent, and decentralized systems—at scale.